Introduction

Over the past decade, the cryptocurrency industry has emerged as a major player in the global financial space. Promoting a “decentralized” and more people-centered approach to finance, cryptocurrencies have taken root among a significant number of investors. As of 2021, the global market has valued the cryptocurrency industry in the hundreds of billions, if not trillions, of USD. The first and most well-known cryptocurrency, Bitcoin, is alone worth USD 653 billion.

The View From the Cryptocurrency Advocates

For many investors and economists, cryptocurrency remains a controversial topic. Bitcoin introduced the world to cryptocurrency a decade ago. However, regulators and investors continue to debate the legitimacy of cryptocurrency. To cryptocurrency advocates, the introduction of this new medium of exchange was the beginning of a new era in the history of economics and finance. To them, widespread cryptocurrency adoption will lead to a global economy longer subject to corruption and cronyism of the large banks and their government backers. In its place, would be a fairer financial system.

These advocates believe that in this new financial system, the consensus of cryptocurrency users would determine the value of the principal medium of exchange. Because the users determine cryptocurrency’s value, the end result would be for the benefit of the community. This stands in contrast to their portrayal of the current system, where governments are in full control of the money supply and issues money to benefit their cronies at the expense of the community.

The View From the Opposition

On the other hand, cryptocurrency’s detractors point out that cryptocurrency violates many long-established rules of economics. They also point out that cryptocurrency is unlikely to achieve these goals outlined above. Detractors point to the poor regulatory record of various cryptocurrencies, and the cryptocurrency’s volatility and speculative nature. Critics believe that cryptocurrency is, at best, a well-intentioned but ultimately misguided attempt to reduce corruption in the financial system. At worst, these critics claim cryptocurrency is a speculative bubble whose main area of use is in fraud and other illicit activities.

A Future for Crypto?

Like many problems, the truth is likely somewhere in between the extremes. The global financial system is likely to accept cryptocurrency as a form of investment for the long haul. However, cryptocurrency is unlikely to achieve its stated higher ambitions and will remain a disappointment for its supporters on this front.

Currently, even as cryptocurrencies grow in popularity, they are losing some of the original reasons for why they were so appealing in the first place. Namely, cryptocurrency is increasingly reflecting the unequal power distribution present in the current financial industry. As mainstream financial investors have finally accepted cryptocurrency, these mega-investment funds are bringing in their enormous financial resources to bear. This development has the effect of increasingly concentrating cryptocurrency ownership in the hands of the few.

Another development is the rising expense of obtaining cryptocurrency. The burgeoning value of the main established cryptocurrencies is making it more expensive for retail investors to explore this asset. Additionally, the equipment used to “mine” the cryptocurrency is becoming more expensive. The combined effect of these developments is to price newcomers out of the industry. It will hinder any cryptocurrency from fundamentally disrupting the financial industry.

What are Cryptocurrency and Blockchain?

Cryptocurrency is a type of virtual asset that relies on the consensus of its users to determine the asset’s value and conduct transactions. Cryptocurrency advocates claim cryptocurrency fundamentally differs from the traditional currencies issued by a state’s central bank. This is because cryptocurrency does away with many of the institutions and infrastructure that are central to the modern financial system.

Any mature modern financial system relies on a network of lenders, clearinghouses, and exchanges to record and settle transactions. This system is beholden to a state’s central bank, whose purpose is to limit inflation and provide money to facilitate economic growth by regulating the amount of money in circulation.

Cryptocurrencies, at least the more established ones, do away with this system and replace it with a network of nodes owned and operated by the cryptocurrency’s users. In the cryptocurrency architecture, there are no middlemen to process and settle transactions. The system moves the currency from the buyer to the seller directly in a peer-to-peer structure. Instead of a central processing system, cryptocurrencies use decentralized nodes to process and settle a transaction. And as part of this process, the system records the transaction in immutable ledgers. The cryptocurrency network also synchronizes these ledgers across the nodes, providing backups and the ability to compare ledgers if they de-sync. The ledger is available for auditing by anyone if they so wish.

Mining

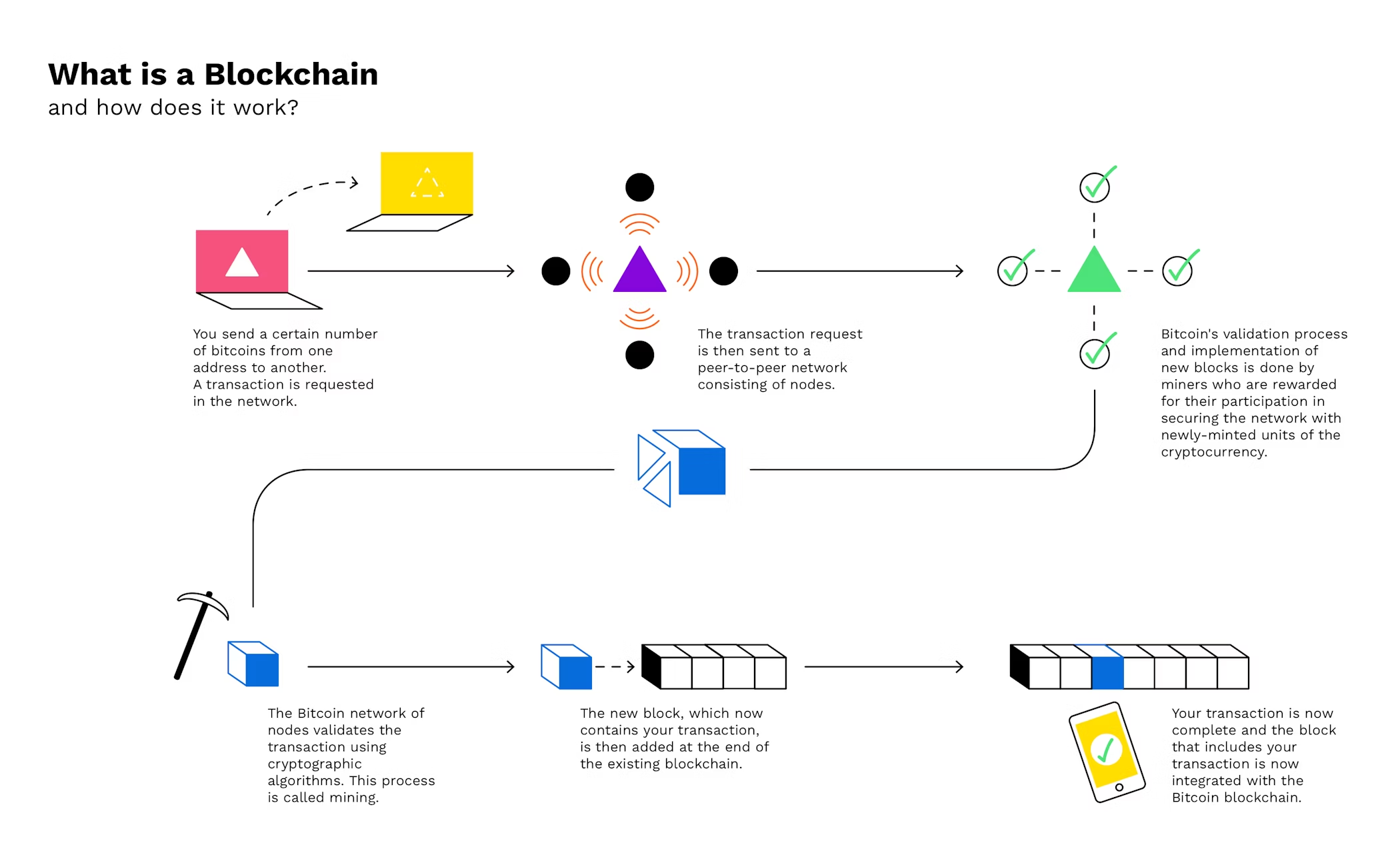

Cryptocurrency systems employ a process generally called “mining” to settle transactions between parties. Mining is the employment of the computation power of a node on the cryptocurrency’s network to verify and settle the transactions made using the currency. Essentially, thousands of computers make billions of calculations every second to come up with a hexadecimal number below a certain value. This process verifies a “block” of transactions and records it in the ledger.

As an incentive for people to donate their computation power, many cryptocurrencies offer rewards in the form of more cryptocurrency to the miner. This reward system in the form of more cryptocurrency also has the added benefit of putting additional cryptocurrency units into circulation.

But in cryptocurrency systems, a miner is not guaranteed rewards for donating their computing power. In the case of Bitcoin, the cryptocurrency network only awards the first node to complete the transaction settlement for its services. This system means that mining for these types of cryptocurrency is a race for the fastest machine calculation to get the reward. A result is a form of “arms race” for increasingly powerful and specialized hardware that can compute the hexadecimal value first. This “arms race” is amply demonstrated by the increasing difficulty of mining Bitcoins. In Bitcoin’s early days, anyone with computing equipment could mine Bitcoin. But today, entrepreneurs in giant mining farms carry out most of the mining operations. These farms use specialized Application-Specific Integrated Circuit (ASIC) mining computers to make calculations at a speed home computing systems cannot hope to match.

Blockchain and Data Protection

How Blockchains Work

Many cryptocurrencies operate on a type of ledger-keeping technology called a blockchain. Blockchain is a type of technology that records transactions made on the network. Cryptocurrency advocates also advertise blockchain ledgers as resistant to tampering, unlike more traditional databases. Blockchains work by having blocks of data (“blocks”) verified by the mining process. The system then stores the verified blocks in a ledger that records the chain of transactions from the beginning.

When a buyer and a seller come together to make a transaction, multiple nodes on the network beings a race to settle the transaction. The blockchain algorithm records in the ledger the work of the first node to complete the processing. The system also records the transaction’s data in a chronological ledger. Finally, the system then distributes the updated ledger to all the nodes on a mining network.

Ledger Immutability

The idea behind this system is the immutability of the ledger through chronological recording and decentralization. The blockchain ledger is immutable because once the data block is stamped and added, the data it records cannot be easily changed like entries in a database. If one wants to change the value of a transaction in a blockchain, the person must first undo all subsequent records to change a single value. This is a very resource-intensive process. Auditors and other users on the network can also quickly realize the records are being tempered.

The second feature of the blockchain ledger is decentralization. With a distributed ledger, tempering with the records theoretically becomes much harder. As multiple records of the same transaction exist, they must all be altered in the same way to be convincing. Hackers must change all existing records on all nodes. This requirement is again very resource-intensive and requires the cooperation of almost all users on the network to work.

In summary, for someone to change a blockchain record, the hacker requires the consensus of all nodes on the network to agree to unwind all subsequent data blocks on all copies of the ledger. Theoretically, this process is very difficult and resource-intensive. This process contrasts with centralized databases. With traditional databases, records can be changed individually by a single user with enough privilege if additional security measures are not implemented.

Encryption

The vital underlying security of all the cryptocurrency networks is the encryption method employed. Like all financial infrastructure, employing a secure encryption algorithm is a necessity to prevent identity theft and record tampering. Different cryptocurrencies employ different encryption types. But in every case, a cryptocurrency’s user identification, digital wallet, and proof of transaction should be encrypted to prevent unauthorized access. As is common in cryptography, sensitive information should not be communicated or stored in plain text. Instead, all sensitive information is converted from plaintext to an encrypted text called a “hash” using a unique encryption key.

The encryption key is a unique mathematical algorithm that converts the plain text into a hash. Reversing this hash without the key should be difficult and requires immense computational power. No one is yet able to reliably crack the most modern encryption algorithms through electronic means. Nevertheless, it is not inconceivable that one day, computational power will grow to sufficient capacity to crack existing cryptocurrency encryptions.

password

b109f3bbbc244eb82441917ed06d618b9008dd09b3befd1b5e07394c706a8bb980b1d7785e5976ec049b46df5f1326af5a2ea6d103fd07c95385ffab0cacbc86

bat

ec864dcbb8285d12716fee137f7ab43ee23a72e3287e4d889131b7b5992eedb7abcb11c87903d73590dfe6953eb5445ede8b4dea91419e6250a3f042ed341551Hashes convert all plain text inputs into a string of certain length. The length of the plain text has no impact on the length of the hash. In the examples above, both the plaintext words “password” and “bat” are encrypted using the SHA512 algorithm.

Implications for Cryptocurrency

Encryption is the key that allows cryptocurrency transactions to be both public and private at the same time. Whereas the ledger records the transactions conducted using the cryptocurrency, it encrypts the identity of the parties to the transactions. In this way, cryptocurrency fulfills its promise of both being more transparent but also provides anonymity to its users.

This is not to say that cryptocurrency has no weak points. As the ever-growing list of hacked cryptocurrency exchanges can testify, cryptocurrency networks do have weaknesses that hackers can exploit. As of 2021, hackers have managed to penetrate the defenses of multiple cryptocurrency exchanges over the years. NASDAQ has an article on some cryptocurrency security flaws which can be found here.

The Good and the Bad

Although cryptocurrency is still in its infancy, it is undeniable it has caused a financial revolution. But whether that revolution will lead to realizing the ideals espoused by cryptocurrency’s advocates or lead to more market instability remains to be seen.

The Good

The good news for many cryptocurrency advocates is that their goal of democratizing finance has succeeded to a certain extent. A veritable end-to-end cryptocurrency infrastructure has developed that offers the same services as their mainstream counterparts. Currently, anyone with a computer and internet connection can engage in the cryptocurrency trade without having to register with organizations such as brokerage houses or banks. Hundreds of thousands of individuals willingly devote computation power at their disposal to settle cryptocurrency transactions.

Organizations outside of the traditional financial systems that serve the needs of crypto users have also developed. Exchanges independent of the major financial institutions have also grown up. Perhaps more importantly, vendors are beginning to accept cryptocurrency as valid payments for goods or services performed. Today, it is possible to speak of a functional global cryptocurrency community that exists parallel to the mainstream financial networks. The crypto networks offer the same types of services as traditional currency and finance institutions. But unlike the traditional financial system, the cryptocurrency network does not need large organizations to facilitate its operations.

And the Bad

The success of cryptocurrency has, however, eroded some of the ideals the most fervent the creators of Bitcoin might have had held. Increasingly, both the mining process and the ownership of different cryptocurrencies are in the hands of ever-smaller numbers of multi-billion financial companies. First, mining the more established cryptocurrencies, such as Bitcoin, is now a full-time job that requires significant infrastructure investment. This high initial investment acts as a barrier to entry that drives small-time miners out of the cryptocurrency market.

Enter the Cryptocurrency Entrepreneur

Replacing the individual miners are cryptocurrency mining companies that have the capital to invest in specialized equipment such as AISCs. Individuals can still mine by participating in mining “pools”. This is where individuals pool together their money and computation power in the race to be the first to mine cryptocurrency blocks. However, as larger investors move in, returns for individuals without the money to upgrade their “mines” to compete have grown increasingly meager. Returns also diminish as a result. A company operating a cryptocurrency mine gets all the rewards for successfully completing a transaction. The system however splits the reward among all participants in a mining pool, which greatly diminishes individual returns. In summary, the economics of scale for cryptocurrency mining favors large centralized operations.

On the wealth front, the ownership of cryptocurrency is becoming concentrated in the hands of a few large account holders. One study claims that only 2% of the ownership accounts currently control as much as 95% of all Bitcoin circulating Bitcoins. It should be of no surprise that as cryptocurrency becomes mainstream, its ownership will reflect the current power imbalance in the finance industry. That is to say, cryptocurrency ownership will reflect the gulf between those who already have significant power in the global financial space can afford to purchase financial assets, and those who do not.

Geographic Concentration

On the geographic front, Bitcoin mines are overwhelmingly concentrated in only a few geographic locations. China, the U.S., Russia are the big three countries that together account for almost 80% of the global Bitcoin mines. They are followed by countries such as Kazakhstan, Malaysia, and Iran. The combination of massive initial capital expense and the electricity required to operate the mines without stop limits mining activities to capital-rich areas with cheap electricity. Perhaps not surprisingly, this demand for capital and cheap electricity mirrors the current global inequality in wealth and standards of living.

It is worth noting that not every cryptocurrency enthusiast is thrilled with these developments. For example, many long-time cryptocurrency advocates accused the cryptocurrency exchange Coinbase of selling out the cryptocurrency when it went public in 2021. These detractors accuse Coinbase of betraying the ideals of the cryptocurrency founders by cozying up to the regulators. They are also unhappy that Coinbase is trying to get the mainstream investment companies involved in the crypto industry. These detractors, perhaps rightly, fear that if the established financial players become involved in the cryptocurrency industry, the industry will evolve into an extension of the crony capitalist enterprise that had propelled them to seek alternatives in the first place.

Where Do We Go from Here?

Cryptocurrency is certainly here to stay. However, whether crypto will remain a niche investment asset or become a widespread currency remains uncertain. It is indisputable that cryptocurrency has moved out of the shadowy realm into Wall Street banks’ limelight. Large financial are now adopting cryptocurrencies as part of their investment portfolios and processing transactions. Therefore, it is likely that cryptocurrency will be part of the financial landscape for some time yet.

What is uncertain is the long-term impact of cryptocurrency. It is unknown whether it will live up to its hype as a more democratic alternative to the existing system. As cryptocurrency becomes increasingly accepted by the mainstream finance industry, many cryptocurrencies are losing one of their original attractions, which was their status as an outsider to the global financial markets. As the cryptocurrency industry matures, the “plucky” founders of the cryptocurrency infrastructure and its early adopters have joined the ranks of the global elite. A dwindling number of financiers and investors are controlling ever-larger shares of both cryptocurrency mining and ownership. As cryptocurrency becomes more “mainstream” and accepted, so will its ownership structure increasingly reflect the current power imbalances in the global financial industry.

Disillusionment with Finance

Cryptocurrency arose out of a time of growing inequality and disillusionment with established institutions. Therefore, cryptocurrency will continue to attract believers for as long as these conditions exist. People’s disillusionment with the established financial system can be readily seen in the fact that millions of people would rather trust a volatile asset with no regulatory oversight over the current financial system. Cryptocurrencies also fulfill the need of many investors to find an asset that can keep its value and is resistant to manipulation. Unfortunately, manipulation is something that many financial institutions have proven time and again to have indulged in. Thus, it is no surprise that many of cryptocurrency’s supporters like to compare crypto to gold. Gold harkens back to a time when the value of a currency was not determined by a few institutions. Many of crypto’s supporters now look to cryptocurrency to provide the same type of assurance.

It is because of this distrust that it is not enough for critics of cryptocurrency to point out crypto’s technical and economic flaws. Even if cryptocurrency proves to be a gigantic bubble that ends in a government bailout, people will not be swayed back to the traditional investment methods. Instead, other forms of financial instruments will arise to take cryptocurrency’s place. Like cryptocurrency, these new financial instruments will promise that they herald a new and more equitable age of finance and “stick to Wall Street”. And like cryptocurrency, the disillusioned of the world will flock to these new instruments. And like cryptocurrency, these instruments’ supporters will defend them, regardless of much economists and financial experts denounce these new instruments.

Bibliography

Bhatia, N. Layered Money: From Gold and Dollars to Bitcoin and Central Bank Digital Currencies. Nikhil Bhatia, 2021. https://books.google.ca/books?id=pP4nzgEACAAJ.

Evangelho, Jason. “Mining 101: An Introduction To Cryptocurrency Mining.” Forbes, March 13, 2018. https://www.forbes.com/sites/jasonevangelho/2018/03/13/mining-101-what-exactly-is-cryptocurrency-mining/.

Hong, Euny, and Julius Mansa. “How Does Bitcoin Mining Work?” Investopedia, May 4, 2021. https://www.investopedia.com/tech/how-does-bitcoin-mining-work/.

Kharif, Olga. “Bitcoin Whales’ Ownership Concentration Is Rising During Rally.” Bloomberg.Com, November 18, 2020, sec. Cryptocurrencies. https://www.bloomberg.com/news/articles/2020-11-18/bitcoin-whales-ownership-concentration-is-rising-during-rally.

Linebaugh, Kate, and Ryan Knutson. “How a Cryptocurrency Company Went Mainstream.” The Journal, n.d.

Small, Takara. “The Body.” A Death In Cryptoland, n.d. https://www.cbc.ca/listen/cbc-podcasts/904-a-death-in-cryptoland.